Latest Facts and News

• The Georgia Department of Revenue (GADOR) introduced an online lien lookup tool in 2023.

• Recent changes to Georgia tax law have extended the statute of limitations for tax liens.

• New legislation allows for easier lien-release processes for taxpayers who settle their debts.

Finding out that a Georgia state tax lien has been placed on your property can be stressful. It’s a public record that can make selling or refinancing difficult, leaving you unsure of what to do next.

You may already know that paying off the debt is the only way to remove the lien, but figuring out the right steps isn’t always easy. With so much information scattered across different sources, it can be frustrating to know where to start.

That’s why we’ve put everything you need to know in one place. This guide will help you understand what a Georgia state tax lien means, how it affects you, and most importantly, what you can do to resolve it. Keep reading to take the next step toward regaining control of your property.

What is a Georgia state tax lien?

A state tax lien is imposed when a taxpayer fails to pay their taxes to the state government. After multiple notices and reminders, the state may take legal action, which can include seizing the taxpayer’s property. Depending on state laws, the government can then sell the property to recover the unpaid taxes.

In Georgia, a state tax lien serves as a tool to compel property owners to settle their tax debts. If the debt is not paid, the government may seize and sell both real and personal property to recover the remaining balance.

While federal tax liens follow a similar process, there are significant differences between state and federal liens that taxpayers should understand.

Difference Between Federal Tax Lien and Georgia State Tax Lien

| Aspect | Federal tax lien | Georgia state tax lien |

| Governing Authority | Internal Revenue System (IRS) | Georgia Department of Revenue (DOR) |

| Scope | Covers all assets in the United States | Applies to all assets located in Georgia |

| Filing and notice | IRS files a “Notice of Federal Tax Lien” to inform creditors and the public. | Georgia DOR files a “State Tax Execution” as public notice to creditors. |

| Priority | Often takes precedence over other claims, except certain secured creditors. | Competes with other state-level claims and follows state-specific priority rules. |

| Resolution Methods | Resolved through full payment, offer in compromise, or IRS programs (e.g., withdrawal). | Resolved through payment, negotiation with DOR, or Georgia-specific settlements. |

| Credit Impact | Appears as a public record and can negatively affect your credit score nationwide. | Also impacts credit as a public record, but specific to Georgia assets. |

How Georgia State Tax Liens Are Filed?

In Georgia, the Department of Revenue (DOR) officially records state tax liens imposed in a step-by-step process explained below:

- Notifying the taxpayer

You need to understand that the Georgia state tax lien is a long process that requires a lot of resources. That is why it is often taken as a last step to make the taxpayer pay. Before filing the lien, the DOR will usually try to collect the tax by penalizing the delinquent taxpayer after the due date.

If the penalty does not coerce the taxpayer, interest is charged. If no response is received still, then a notice is sent of the lien being filed. As per the due date mentioned in the notice, if the taxpayer does not respond to the notice by then, only then is the lien filed.

- Filing the lien

At the end of the due date, if there is still no response from the defaulting taxpayer, a public lien is filed by approaching the Clerk of Superior Court. The property, being a tax lien property, becomes public information when the lien is filed.

A property having a state tax lien attached to it can still be sold or transferred, but as the lien attached to it is not influenced even with the changing ownership, it is very unlikely that it will have the same value as it had before the lien, and as the lien still needs to be paid for, it deters potential buyers.

If there is still no response to the filing of the lien, the DOR has full rights to sell the lien property to another buyer and claim the lien amount from the sale as the tax that was due. After it is sold to a new owner, the delinquent taxpayer has one year to claim back the property before it is fully transferred to the new owner.

- Claiming Back the Lien Property Before New Ownership is Finalized

Even after the property is sold to the new owner, the defaulting taxpayer has a period of one year to claim back the property before the new owner can have the full right to his property. The original property owner can claim back the property (which is no longer a lien property) by paying the new owner.

This amount to be paid to the new owner includes all the money spent by the new owner in order to buy that property, any property tax paid by him to the government thereafter, or any other amount spent by him in relation to this property. After all dues have been paid, the taxpayer can reclaim his property as it was before the lien.

The Role of the Superior Court Clerk

The Clerk of the Superior Court is responsible for:

- Document all liens filed and ensure public accessibility with relevant details.

- Facilitates Georgia state tax lien filings by processing requests from the DOR.

- Ensures lien enforceability in cases where unpaid tax payments remain pending.

- Maintains records of property encumbrance and tracks all lien-related filings.

- Clears liens upon tax debt resolution and updates public records accordingly.

Georgia State Tax Lien Lookup: How to Search for Liens?

In case you face property title issues, you can contact the Clerk of Superior Court’s office situated in the same county as your property to inquire about their office timings, the lien lookup process, the lien resolution process, and any fees charged from any of the above processes.

Different counties may follow different rules and procedures; for instance, the official website of Camden County in Georgia has all the information you may require for looking up and resolving liens.

Although there are counties with online websites full of updates and rules of lien repayment and other county work information, it is still a good idea to approach the offline office to confirm the details from the Clerk of Superior Court.

If you still want to look it up online without having to visit, you can also make use of SOLVED: Search for a lien. Alternatively, the website of Georgia Superior Court Clerks’ Cooperative Authority (GSCCCA) also has the option to look for liens online, which is accessible for anyone who wants to quickly and efficiently verify liens from anywhere.

Using the Georgia Tax Center for Lien Searches

Visit the online website of the Georgia Tax Center and follow the steps given below to perform a Georgia state tax lien lookup.

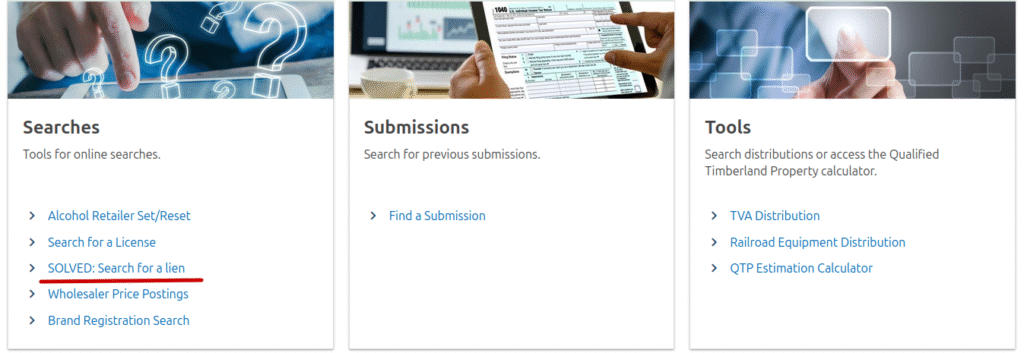

- Scroll down the above link and find the ‘Searches’ section to access tools for online searches.

Look for the “SOLVED”. Search for a link in that section highlighted in the below-given screenshot.

- This link will redirect you to a popup with the use terms of the tool. Go through it and accept it, and by doing so, you agree to follow the terms.

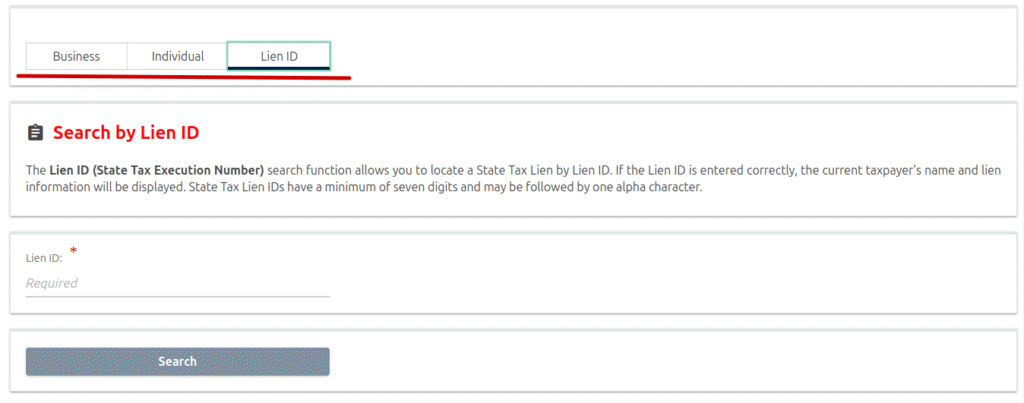

- By default, when the tool loads, you have the option to search for a lien by the lien ID.

You can also search for a lien by the person’s name and the last four digits of their SSN or ITIN, or if it is a business, then by its name and the last four digits of its FEIN.

If you want to search for a lien by anything other than its ID, you first need to toggle the search option before you input the required information.

The screenshot of the page below shows the option from which you can switch the search:

The Impact of tax liens on Property Owners

Having a tax lien attached to a property can have long-lasting effects on the finances of the delinquent taxpayer. Here is how a tax lien can significantly harm their finances:

- Damage to the Credit Score

Although the credit companies are not formally notified of the property lien, the public is aware of the taxpayers who have lien properties registered in their names. A thorough background check by credit companies can reveal the lien imposed.

- Property Encumbrance Makes Selling Property Difficult

Lien properties are still allowed to be sold and transferred; however, selling or transferring the property cannot remove the lien attached to it due to the rules for tax collection enforcement. The lien amount must be paid to remove the tax lien.

- Property Seizure in Case of Non-Payment

If the taxpayer still does not respond to the DOR upon being sent notice for lien, the government has the full authority to seize the property and sell it. Recovering a property thus sold is possible, but it becomes even more expensive for the taxpayer.

- Challenges Upon Inheritance

Even in the case of a delinquent taxpayer’s death, the lien on the property is not removed, making it challenging for the inheriting heir to obtain homeowner’s insurance. The lien on the property still needs to be paid to initiate the lien release process.

Resolving a Georgia State Tax Lien

The Georgia taxation system rules, even if they are strict, are here to help you pay your taxes. The Georgia Department of Revenue recognizes this and offers a number of ways for you to repay your taxes and remove the lien:

- Paying Off the State Tax Debt

By paying off the state tax debt in full, the lien can be removed from the records. In this method, once the lien is struck off, the owner can sell that same property or refinance it without worrying about the Georgia state tax lien.

- Partial Lien Release

The delinquent taxpayer can get a partial release on specific parts of the property by paying off part of the pending tax dues upon agreement with the GADOR. Hiring a Georgia tax attorney can help you resolve the tax debt without having to worry about the formal legal processes.

- Lien Subordination

In case you need to refinance your property, lien subordination is an available option that is also acceptable to GADOR. Through this method, although the state tax lien is still not removed, it does take a second priority after the mortgage lender, who gets the first priority.

In order to avail yourself of this option, you either need to pay off the portion of tax debt that is equal to the lien interest being subordinated or prove to GADOR officials that lien subordination is in the best interests of due tax repayment.

- Offer in Compromise

GADOR allows Offer in Compromise for state tax just like the IRS does for federal taxes. By negotiating with GADOR and agreeing to a payment plan for tax repayment, you are allowed to repay your due taxes over time at a more affordable rate in installments. This also avoids further tax collection actions from the state government.

The Bowes and Sullivan tax group provides options to hire a tax attorney specializing in lien repayment to GADOR.

- Seeking a Lien Withdrawal

If you believe the lien was filed in error, you can request a withdrawal. If the DOR determines that the lien was indeed erroneous, they will withdraw it.

- Waiting for Lien Expiration

Liens expire after ten years unless they are extended due to specified special circumstances. A lien cannot be enforced after it has expired, so your property will be safe after ten years if no action is taken by GADOR. However, as the tax still remains unpaid, other methods can still be employed for tax collection enforcement.

Preventing Georgia State Tax Liens

The Georgia state tax lien is enforced as a last resort to account for and collect the unpaid taxes from the delinquent taxpayer, since filing and going through with the lien process to get back the amount owed is an expensive process, even for DOR. Here are some guidelines to prevent a Georgia state tax lien from being filed on your property:

- Pay Your Taxes on Time

Ensure that you pay the state tax due before the last date. Timely tax payments ensure that the interest and penalty are not levied and that they do not accumulate and they also prevent the filing of a lien.

- Respond to Notices Received

Ignoring the notices sent to you by GADOR may lead to lien filing. Stay updated with the notices they send and respond promptly to them in order to keep yourself informed of the pending dues and to make it easier for you to negotiate with GADOR on time.

- Know Your Options

The tax repayment options discussed above for resolving a lien can be availed of sooner as well before the lien is filed. Study the official government website and go through credible blogs to keep yourself updated on the repayment options.

- Document Everything

Keep detailed records of all conversations and actions taken when in correspondence with DOR, tax filing, payments made, and any official communication. These personal records help you keep yourself informed and act as legal evidence in case an erroneous lien is being filed.

- Avail Expert Legal Aid

It is a good idea to avail yourself of legal expertise to avoid complicated tax situations. Attorneys familiar with the laws of Georgia can help you avoid liens and also help you in successfully resolving liens filed against you.

Is Georgia a tax lien state? Understanding the State’s Approach

In order to answer ‘Is Georgia a tax lien state?’, you need to understand the below-given difference between a tax deed and a tax lien state, given in the table below:

| Tax Lien State | Tax Deed State |

| In a tax lien state, the government files a property lien in the case of nonpayment of taxes. The property can be sold by the authority to claim the due taxes, but the new owner does not have full rights to the property bought by him until a period of one year passes without the original owner reclaiming it. | In a tax-deed state, the government can recover the unpaid taxes by auctioning off the property and selling it with the full property rights to the highest bidder. |

| Georgia, Florida, and Arizona are tax lien states. | Alaska, California, and Hawaii are tax-deed states. |

Since Georgia enforces tax debt resolution by filing a lien and then selling it on no response from the current owner rather than auctioning it off outright to the new owner, Georgia is a tax lien state.

Protect Your Property From Lien With Bowes and Sullivan!

Resolving a property lien can be a draining and expensive process, and every step taken to resolve an active lien matters. Time is of the essence as well, since a lien once filed can be enforced at any time to collect pending dues, increasing the payment amount and restricting financing options for repayment.

By contacting Bowes and Sullivan Tax Group, you get actionable tax advice and solutions to prevent property liens from freezing your remaining financial options and clouding your future. How you resolve the property lien will affect your financing options even in the future, after all.

FAQs

How long does a Georgia state tax lien last?

Every state tax lien recorded in Georgia lasts ten years from the date of filing. Unless the date has been extended due to any of the specific reasons outlined by DOR, the lien cannot be renewed after ten years.

Can I sell my property if there’s a state tax lien on it?

There is no rule against selling a property with a state tax lien on it, though even after it is sold to a new owner, the state tax lien on the property remains attached and enforceable, which may deter buyers from buying it.

What’s the difference between a tax lien and a tax levy in Georgia?

A tax lien is a legal claim placed on your property due to unpaid taxes. It doesn’t result in an immediate seizure but can limit your ability to sell or refinance until the debt is paid.

A tax levy is the seizure of assets—such as bank accounts, wages, or property—to directly satisfy the tax debt. Unlike a lien, a levy takes ownership of assets without prior public notice.

How does a Georgia state tax lien affect my credit score?

Even though a tax lien does not impact the credit score directly, it can negatively affect your ability to take loans and avail yourself of finance options in the future. The records are not directly shared with credit companies, but they are publicly available and can appear in comprehensive background checks.

Can I remove a Georgia state tax lien without paying the full amount owed?

To remove a Georgia state tax lien, the entire amount must be paid before it is resolved. Even if an installment payment agreement is set up with DOR, the lien is not removed until the entire amount is paid in accordance with the terms.