If you’re a small business owner facing payroll tax trouble, growing IRS penalties can threaten to shut everything down. When payroll taxes pile up, the debt snowballs fast, and the IRS doesn’t wait long before taking action. However, to tackle this, business owners have an option to file Form 433-B. This form can open the door to real tax debt relief, allowing you to explain your situation, protect your assets, and negotiate fair terms to settle payroll tax debt before enforcement begins.

In this blog, we’ll explain exactly how IRS Form 433-B works, when you should file it, and how it can help your business regain control before the IRS does it for you.

Understanding IRS Form 433-B and Its Role in Payroll Tax Debt Help

Form 433-B (Collection Information Statement for Businesses) tells the IRS everything about your company’s finances. It shows how much money comes in, where it goes, and what’s left. The IRS uses it to decide if your business qualifies for payroll tax debt help or must pay in full. Here’s what the IRS uses it for:

- To see if your business can afford to pay all back payroll taxes now.

- To check if a business tax payment plan is possible.

- To evaluate eligibility for programs like an Offer in Compromise, or a Tax debt installment agreement.

- To verify claims you make during IRS tax debt negotiation.

Payroll taxes are trust-fund taxes (money you withhold from your employees’ paychecks). The IRS treats them seriously. If you fall behind, the agency can impose severe penalties and even hold you personally liable. If you ignore requests for it, the IRS can assume you’re hiding income and may move to seize bank accounts or property. Filing Form 433-B proves that you’re trying to fix the problem rather than avoid it.

When and How to File Form 433-B for Payroll Tax Debt Help?

Filing time depends on your situation. Generally, you file Form 433-B when:

- The IRS Revenue Officer formally requests it.

- You’re applying for an installment agreement or a tax debt installment agreement.

- You’re seeking an Offer in Compromise from the IRS to reduce total debt.

- You want your business classified as Currently Not Collectible.

- You’re responding to a final notice or collection call.

Step-by-Step Guide to Completing Form 433-B Accurately

Before you start filling in numbers, get your documents in order. Collect bank statements for the past six months, recent payroll records, credit card statements, loan schedules, and copies of business tax returns.

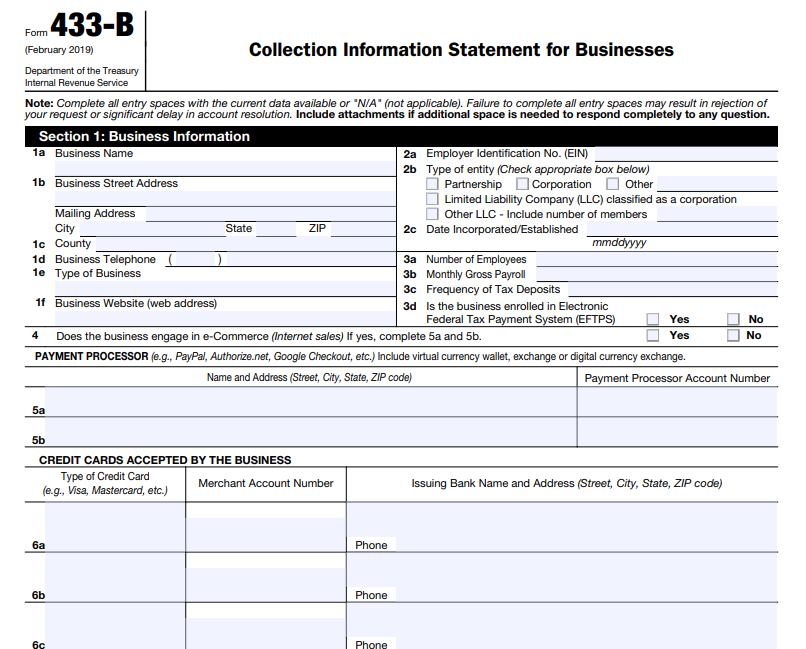

Section 1 – Business Information

This part identifies your business. It asks for:

- Business name, address, phone, and website.

- Employer Identification Number (EIN).

- Type of entity (LLC, Corporation, Partnership, etc.).

- Number of employees and how often you deposit payroll taxes.

- Whether you use EFTPS (Electronic Federal Tax Payment System).

- e-Commerce and credit card processing details.

All this tells the IRS how your payroll system works. If you aren’t using EFTPS or if deposits are late, it gives clues about where payroll problems started.

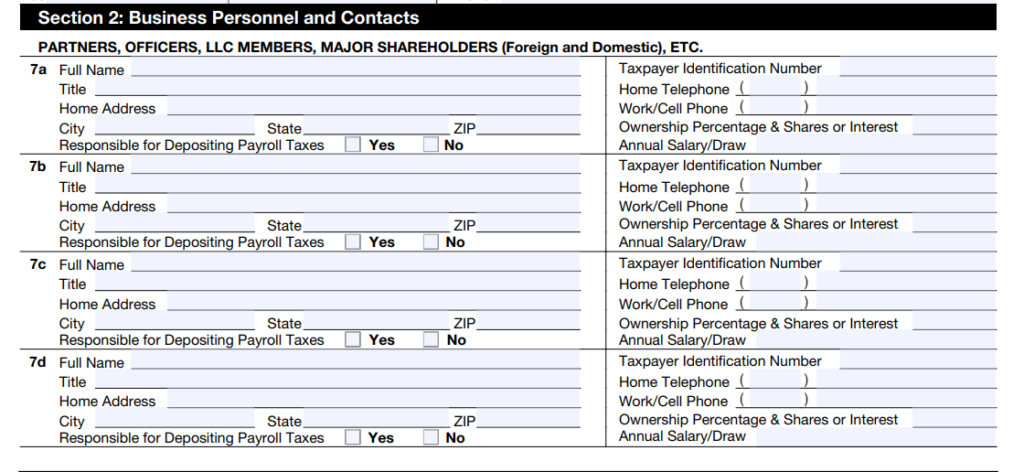

Section 2 – Business Personnel and Contacts

Here you list every owner, officer, partner, or LLC member who controls money or payroll. The IRS focuses hard on one box: “Responsible for Depositing Payroll Taxes—Yes/No.” Anyone who checks “Yes” can be personally assessed under the Trust Fund Recovery Penalty (TFRP). So answer truthfully.

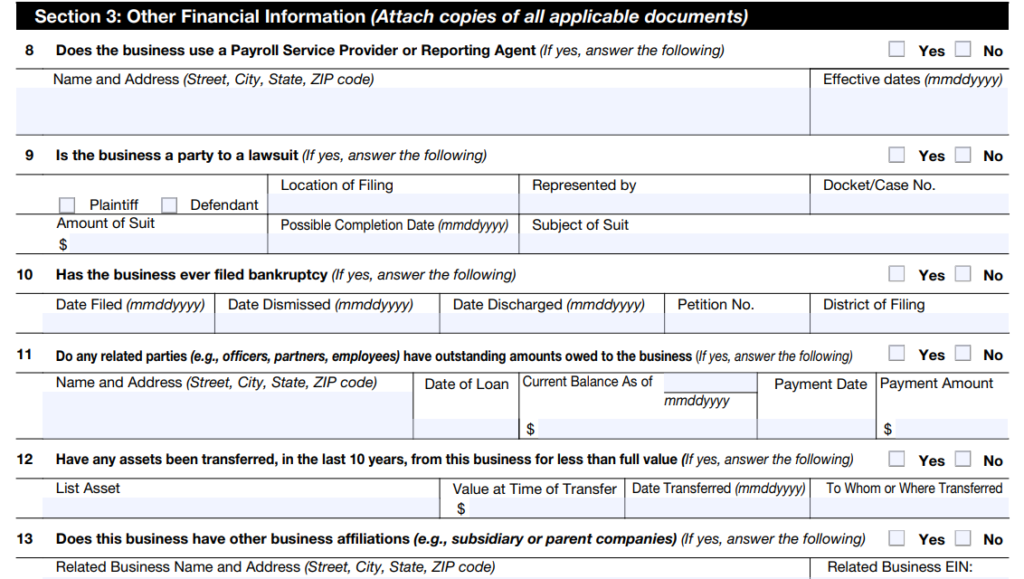

Section 3 – Other Financial Information

This section dives into the legal and financial background:

- Payroll service provider details.

- Any lawsuits your business is involved in.

- Bankruptcy history.

- Loans to or from officers or related companies.

- Asset transfers within the last 10 years.

- Affiliated businesses and expected income changes.

The IRS uses this part to detect hidden transfers or side entities. If you moved property to another business or relative, they’ll catch it here.

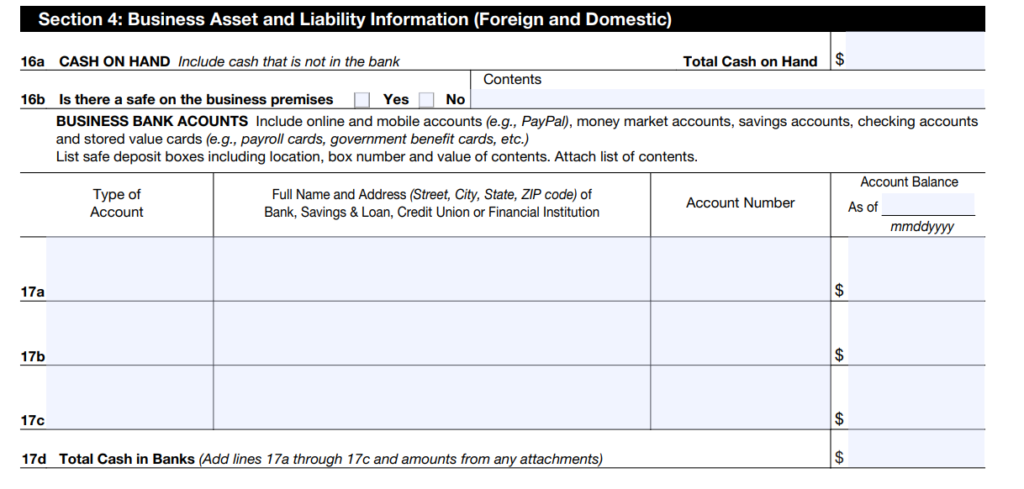

Section 4 – Business Assets and Liabilities

This is the meat of the form. It asks for every business asset and debt:

| Category | What You Must List | Examples |

| Cash and Bank Accounts | Balances, account numbers, safe deposit boxes. | Checking, savings, PayPal, merchant accounts. |

| Accounts Receivable | Customer balances and contracts. | Invoices, government contracts. |

| Investments | Stocks, bonds, crypto, CDs. | Include loans and collateral values. |

| Credit Lines | Credit cards and business loans. | Show limits, balances, and available credit. |

| Real Property | Buildings or land the business owns or leases. | Provide FMV and loan balances. |

| Vehicles | Owned or leased cars and equipment. | Include VIN, FMV, and loan details. |

| Equipment & Inventory | All machinery, stock, licenses, and software. | Attach separate lists if needed. |

| Business Liabilities | Notes and judgments not listed elsewhere. | Bank loans, vendor financing. |

You also state each asset’s fair market value (FMV), loan balance, and monthly payment. The IRS uses these figures to find your “net equity,” which could be liquidated to pay taxes.

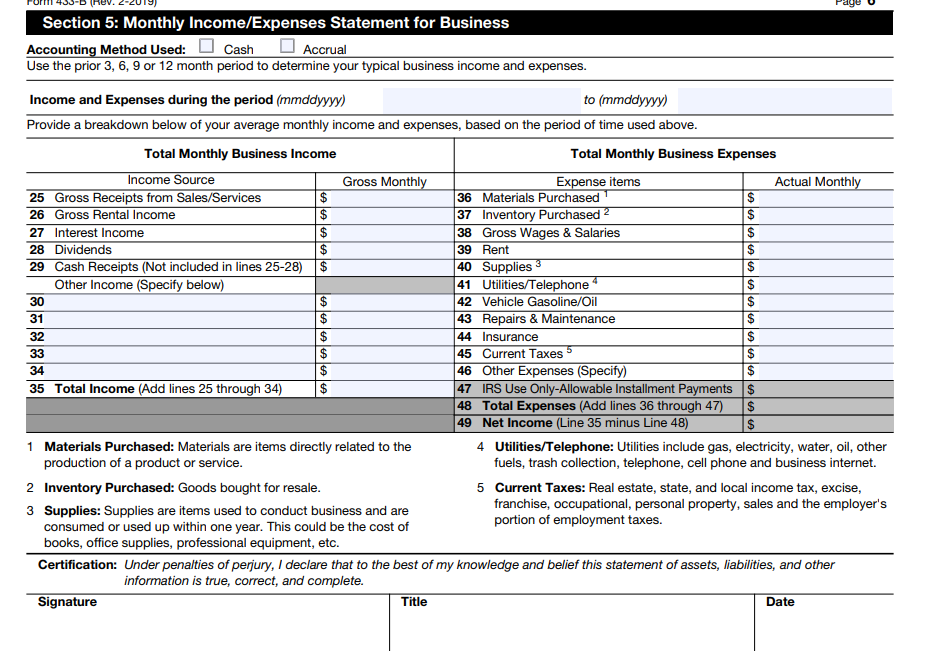

Section 5 – Monthly Income and Expenses

The last part captures your cash flow. The IRS wants a realistic 3-, 6-, 9-, or 12-month average of:

- Gross receipts from sales or services.

- Rental and interest income.

- Wages and payroll costs.

- Rent, utilities, insurance, supplies, taxes, and repairs.

At the bottom, you’ll calculate Net Income (total income minus total expenses). That’s the number the IRS uses to decide what you can afford. After completion, the business owner must sign under penalty of perjury.

Strategies to Settle Payroll Tax Debt Using Form 433-B

Once you’ve completed IRS Form 433-B, the next step is deciding how to use it. It determines what type of payroll tax debt relief your business qualifies for and how you can settle payroll tax debt with the least damage. The table below walks through the main settlement options the IRS allows and how each one works in the real world.

| Option | Pros | Cons | Best For |

| Installment Agreement | Predictable monthly plan; prevents levies. | Interest and penalties continue. | Stable businesses. |

| Offer in Compromise | May pay less than the total owed. | Hard to qualify; long review. | Financial hardship cases. |

| Currently Not Collectible | Stops IRS enforcement. | Debt continues to grow. | Businesses in crisis. |

| Partial Payment Plan | Affordable, flexible. | Periodic IRS review. | Limited income but ongoing operations. |

The right choice depends on your income, assets, and goals. For many small businesses, an installment plan is the fastest way to get payroll tax debt help and avoid seizure.

Common Mistakes to Avoid When Filing Form 433-B

Even honest business owners make small mistakes that delay or ruin their chances of relief. Here are the most common mistakes small business owners make:

- Leaving blanks: Write “N/A” if something doesn’t apply.

- Using estimates: Don’t guess on balances or values. Use actual bank statements and invoices.

- Omitting assets: The IRS cross-checks with public records, banks, and tax filings. If they find something you didn’t list, it looks like you’re hiding assets.

- Not updating the IRS: If your business changes location, bank, or payroll provider, tell them. Silence makes them think you’re dodging contact.

- Ignoring the “responsible party” question: Anyone listed as responsible for payroll deposits could be personally liable. Make sure that the section is true and accurate.

- Skipping documentation: The IRS wants proof. Missing statements are one of the top reasons for rejected submissions.

Avoiding these mistakes can save you months of back-and-forth and increase your chance of settling payroll tax debt successfully.

Resources for Payroll Tax Debt Help and Professional Assistance

Dealing with the IRS alone is risky if you don’t fully understand how Form 433-B fits into their collection process. These resources can help:

- IRS.gov – Business Payment Plans: Learn about business tax payment plans and online installment requests.

- Offer in Compromise Pre-Qualifier Tool: Check your eligibility for an Offer in Compromise with the IRS before submitting.

- IRS Publication 594: Explains how the collection process works, from notices to levies.

- Tax experts of Bowes & Sullivan: Our CPAs, tax attorneys, or enrolled agents with experience in IRS tax debt negotiation can handle communication and make sure your form is bulletproof.

If your business has multiple entities, our experts will prepare a full IRS financial statement business analysis to make sure every number matches the IRS database.

Settle Payroll Tax Debt with Bowes & Sullivan

If you think the IRS will “wait it out,” you’re already on borrowed time. Payroll tax debt grows, and once a Revenue Officer steps in, it’s game over unless you act fast. That’s where Bowes & Sullivan comes in. We don’t just fill out IRS forms; we fight for your business. Our experts know exactly how to use IRS Form 433-B to secure real payroll tax debt help and settle payroll tax debt before the IRS freezes your accounts or seizes your assets. We analyze your full financial picture, talk directly with the IRS on your behalf, and build a settlement strategy that protects your business, your cash flow, and your peace of mind. Your business can survive this, but only if you move now.

Contact Bowes & Sullivan today before the IRS decides for you.

FAQs

Q1. What happens if I don’t file Form 433-B when requested?

If you ignore the IRS request, they’ll assume you’re refusing to cooperate. That often leads to immediate collection actions, such as bank levies, tax liens, or wage garnishments. Filing Form 433-B quickly is your only chance to show good faith and request payroll tax debt help before things escalate.

Q2. Can I file Form 433-B without a Revenue Officer assignment?

Yes. You can submit it voluntarily when asking for a payment plan or to settle payroll tax debt. Doing it early proves you’re proactive and helps prevent the IRS from assigning a Revenue Officer, something that usually means higher pressure and faster enforcement.

Q3. How long does the IRS take to review Form 433-B?

Processing typically takes four to twelve weeks, depending on your case and how complete your documentation is. Missing statements, errors, or unverified numbers slow things down. A clear, fully supported submission helps the IRS move faster and improves your chance of payroll tax debt help approval.

Q4. Are there penalties for inaccurate information on Form 433-B?

Yes, the form is signed under penalty of perjury. Submitting false or incomplete details can trigger civil penalties, rejected settlements, or even criminal charges. Always use verified financial data and attach documents that back up every number; honesty speeds up approval for payroll tax debt help.

Q5. Can Form 433-B help reduce penalties on payroll tax debt?

The form itself doesn’t remove penalties, but it lays the groundwork for relief. It gives the IRS a full view of your business finances, which you can use to request a payroll tax penalty reduction or a reasonable-cause abatement when trying to settle payroll tax debt.